January 15

Charging stations for electric cars may be considered CSR activity

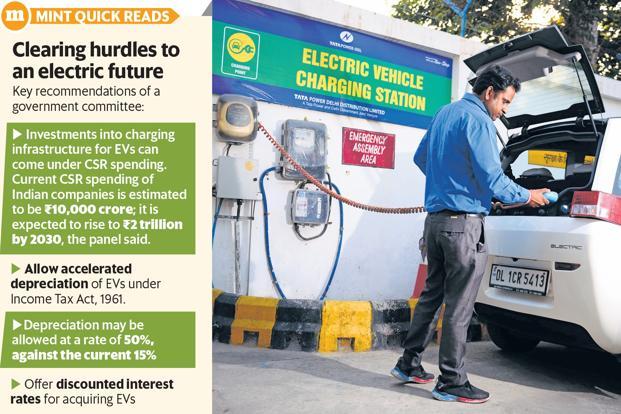

New Delhi: Expenses incurred by manufacturing companies in setting up charging stations for electric vehicles across the country should be considered an activity within the ambit of corporate social responsibility (CSR), a committee formed under the secretary of the transport ministry has recommended.

The proposal has been made to facilitate adoption of electric mobility in India, where setting up charging infrastructure is becoming a major impediment. Recently, the government-owned Energy Efficiency Services Ltd (EESL) could not procure enough electric cars from Mahindra and Mahindra Ltd and Tata Motors Ltd because of the lack of charging stations across the country.

The committee’s report also said that higher depreciation on electric vehicles is required, along with incentive or weighted deductions for investments in the electric mobility space.

The committee was set up by the government to suggest measures to promote electric mobility in India through non-fiscal incentivization and promote electrification in public transport and last-mile connectivity.

Mint has reviewed a copy of the report, which was submitted to NITI Aayog, the policymaking arm of the Union government.

Other such recommendations from five different ministries—finance, heavy industries, information technology, earth sciences and environment—will also be submitted to NITI Aayog in the near future.

“The government should consider allowing expenditure incurred for charging infrastructure as CSR expenditure. India’s CSR spending is estimated to be around ₹10,000 crore annually and is expected to be around ₹ 2 trillion by 2020. Part of this can be used to create charging infrastructure if companies are allowed to invest in charging infra and ecosystem development as part of their CSR activities,” the committee said in one of its recommendations.

It also suggested that the government allow accelerated depreciation under Income Tax Act of 1961 on purchase of electric vehicles, allowing businesses to quickly deduct the full cost of their investments.

“The depreciation of EVs may be allowed at a rate of 50% against a rate of 15% allowed at present,” the committee said. “This may be allowed for a period of five years to provide a clear road map to stakeholders.”

The panel suggested that a discounted rate of lending be explored by the government for acquisition of electric vehicles, along with further tightening of fuel efficiency norms, which may become a headache for the manufacturers.

“The recommendation, if accepted by the government, will come as a huge boost to the whole industry,” a senior industry executive said on condition of anonymity. “Big corporate houses have huge budgets for CSR spending and if they can spare a minuscule part of it in setting up charging infra then it will help boost the whole industry. The accelerated deduction under the Income Tax Act will also encourage people to buy EVs.”

The Union government, which has decided not to formulate an India EV policy, has decided to work on an action plan for promotion of electric vehicles. Subsequently, six committees were constituted under the secretaries of different ministries for drawing up guidelines on different aspect of electric mobility.

Any abrupt tightening of fuel efficiency norms may have an adverse impact on the companies as most of them have already started working on vehicles with the Corporate Average Fuel Efficiency Norms (CAFE) norms in mind. These norms will be implemented in 2022.

“As of now, the two major concerns in electric mobility are generating volumes and attracting investments. These recommendations will help boost investment and on the consumer side, the tax benefits will act as a catalyst for demand for electric vehicles,” said Puneet Gupta, associate director (vehicle sales forecasting) at IHS Markit, a market research and vehicle sales forecasting firm.